-

Recent Posts

- What ISIS Really Wants – The Atlantic

- The austerity delusion | Paul Krugman | Business | The Guardian

- Bellingham, WA with Mt. Baker in the background

- (no title)

- Seattle Skyline

- How politics makes us stupid – Vox

- Nell and Trent’s Wedding

- San Francisco Panorama

- What happened to US life expectancy? | The Incidental Economist

- US Health Map | Institute for Health Metrics and Evaluation

Archives

- November 2015

- April 2015

- January 2015

- June 2014

- April 2014

- March 2014

- January 2014

- December 2013

- November 2013

- October 2013

- July 2013

- June 2013

- May 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- September 2012

- August 2012

- July 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

Categories

Meta

Deficit Hypocrisy – NYTimes.com

Posted in Uncategorized

Comments Off on Deficit Hypocrisy – NYTimes.com

Orcas in our Front Yard

We’ve been here over 5 years and this is the first time we’ve seen orcas from our house — nice Christmas present.

Posted in Uncategorized

1 Comment

Even more evidence that gov’t spending is not exploding

Posted in Uncategorized

Comments Off on Even more evidence that gov’t spending is not exploding

More Evidence that Government is Not Growing out of Control

Notes On Government Employment – NYTimes.com.

Posted in Uncategorized

Comments Off on More Evidence that Government is Not Growing out of Control

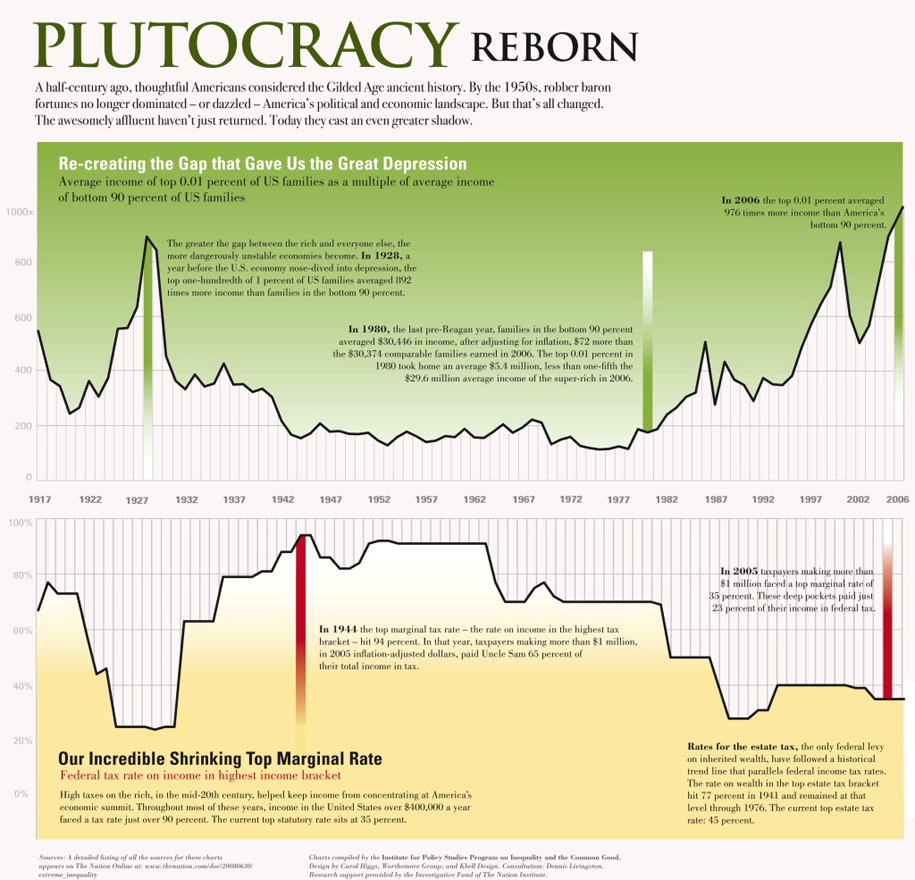

The Growing Income Gap

More on the growing income gap — and the diminishing top marginal tax rate from Business Insider.

Posted in Uncategorized

1 Comment

The Financial Crisis — How it Started and How We Let It Develop

Posted in Uncategorized

Comments Off on The Financial Crisis — How it Started and How We Let It Develop

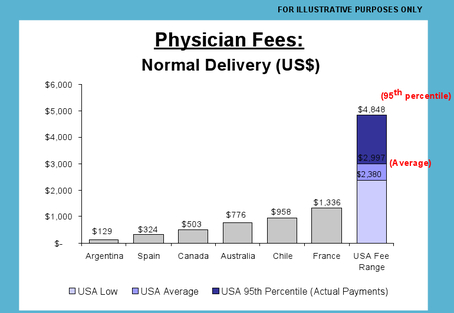

Ezra Klein – Americans pay too much for health care — in charts

“Mountains of research show that for every piece of care you might name — a drug, a doctor visit, a diagnostic — you’ll pay far more in the United States than in other countries.”

via Ezra Klein – Americans pay too much for health care — in charts.

Many more charts here.

Posted in Uncategorized

3 Comments

Yglesias » Paul Ryan’s Monetary Economics

Ryan seems to be equivocating between two proposals, one irrelevant and the other insane.

Posted in Uncategorized

Comments Off on Yglesias » Paul Ryan’s Monetary Economics

Brad DeLong on Paul Krugman on the Axis of Depression

Brad DeLong discusses Paul Krugman’s column:

….

Today we have next to no hard-money lobby, for nearly everybody has a substantially diversified portfolio and suffers mightily when unemployment is high and capacity utilization and spending are low. …

But here we are, with Austerians. So cui bono? Who benefits from austerity in the U.S.? How in the North Atlantic can we have a large political movement pushing for the hardest of hard-money policies when there is no hard-money lobby with its wealth on the line? How is it that the unemployed, and those who fear they might be the next wave of unemployed, do not register at the electoral polls? Why are politicians not terrified of their displeasure? … Why is the idea…that the first task of the government is to undertake strategic interventions in financial markets to stabilize the flow of economy-wide spending now a contested one?

Paul sees a material interest link: he sees German and Chinese governments that seek a continued large U.S. trade deficit to allow their export surpluses, Republican politicians who think trashing the economy is the way to majorities, and economists who think that supporting Republican politicians is the road to influence. I don’t think that can be a complete explanation: very few people are comfortable living with the idea that they are villains wreaking destruction on the world for their own narrow advantage.

Thus I read Charles Calomiris’s claim that it is inappropriate for the Federal Reserve to aim for a short-term nominal GDP growth rate above 5% per year no matter how high the unemployment rate, and I am simply bewildered…

via Paul Krugman on the Axis of Depression – Grasping Reality with Both Hands.

I have no problem believing that people can ignore suffering elsewhere and put their bank accounts first.

Posted in Uncategorized

Comments Off on Brad DeLong on Paul Krugman on the Axis of Depression

A Hedge Fund Republic? – NYTimes.com

What kind of a country do we aspire to be? Would we really want to be the kind of plutocracy where the richest 1 percent possesses more net worth than the bottom 90 percent?

Oops! That’s already us. The top 1 percent of Americans owns 34 percent of America’s private net worth, according to figures compiled by the Economic Policy Institute in Washington. The bottom 90 percent owns just 29 percent.

Posted in Uncategorized

Comments Off on A Hedge Fund Republic? – NYTimes.com