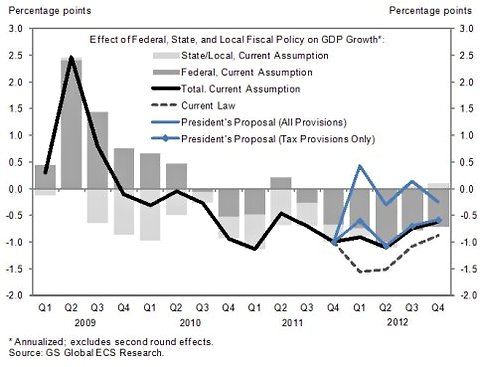

What the world needed in this global deleveraging crisis was deficit spending and higher inflation targets. What it got was fiscal austerity and obsessive concern with inflation risks that weren’t real. Hence the catastrophe now unfolding.

Judging from recent comments, many readers missed my earlier analyses on these issues — I’m still getting the “You idiot, debt got us into this mess, how can debt get us out?†type of comment. So let me re-repost my discussion of this whole issue in full, followed by a couple of brief notes on the European situation.

The original post:

Sam, Janet, and Fiscal Policy

One of the common arguments against fiscal policy in the current situation – one that sounds sensible – is that debt is the problem, so how can debt be the solution? Households borrowed too much; now you want the government to borrow even more?

What’s wrong with that argument? It assumes, implicitly, that debt is debt – that it doesn’t matter who owes the money. Yet that can’t be right; if it were, we wouldn’t have a problem in the first place. After all, to a first approximation debt is money we owe to ourselves – yes, the US has debt to China etc., but that’s not at the heart of the problem. Ignoring the foreign component, or looking at the world as a whole, the overall level of debt makes no difference to aggregate net worth – one person’s liability is another person’s asset.

It follows that the level of debt matters only if the distribution of net worth matters, if highly indebted players face different constraints from players with low debt. And this means that all debt isn’t created equal – which is why borrowing by some actors now can help cure problems created by excess borrowing by other actors in the past.

To see my point, imagine first a world in which there are only two kinds of people: Spendthrift Sams and Judicious Janets. (Sam and Janet who? If you’d grown up in my place and time, you’d know the answer: Sam and Janet evening / You will see a stranger … But actually, I’m thinking of the two kinds of agent in the Kiyotaki-Moore model.)

In this world, we’ll assume that no real investment is possible, so that loans are made only to finance consumption in excess of income. Specifically, in the past the Sams have borrowed from the Janets to pay for consumption. But now something has happened – say, the collapse of a land bubble – that has forced the Sams to stop borrowing, and indeed to pay down their debt.

For the Sams to do this, of course, the Janets must be prepared to dissave, to run down their assets. What would give them an incentive to do this? The answer is a fall in interest rates. So the normal way the economy would cope with the balance sheet problems of the Sams is through a period of low rates.

But – you probably guessed where I’m going – what if even a zero rate isn’t low enough; that is, low enough to induce enough dissaving on the part of the Janets to match the savings of the Sams? Then we have a problem. I haven’t specified the underlying macroeconomic model, but it seems safe to say that we’d be looking at a depressed real economy and deflationary pressures. And this will be destructive; not only will output be below potential, but depressed incomes and deflation will make it harder for the Sams to pay down their debt.

What can be done? One answer is inflation, if you can get it, which will do two things: it will make it possible to have a negative real interest rate, and it will in itself erode the debt of the Sams. Yes, that will in a way be rewarding their past excesses – but economics is not a morality play.

Oh, and just to go back for a moment to my point about debt not being all the same: yes, inflation erodes the assets of the Janets at the same time, and by the same amount, as it erodes the debt of the Sams. But the Sams are balance-sheet constrained, while the Janets aren’t, so this is a net positive for aggregate demand.

But what if inflation can’t or won’t be delivered?

Well, suppose a third character can come in: Government Gus. Suppose that he can borrow for a while, using the borrowed money to buy useful things like rail tunnels under the Hudson. The true social cost of these things will be very low, because he’ll be putting resources that would otherwise be unemployed to work. And he’ll also make it easier for the Sams to pay down their debt; if he keeps it up long enough, he can bring them to the point where they’re no longer so severely balance-sheet constrained, and further deficit spending is no longer required to achieve full employment.

Yes, private debt will in part have been replaced by public debt – but the point is that debt will have been shifted away from severely balance-sheet-constrained players, so that the economy’s problems will have been reduced even if the overall level of debt hasn’t fallen.

The bottom line, then, is that the plausible-sounding argument that debt can’t cure debt is just wrong. On the contrary, it can – and the alternative is a prolonged period of economic weakness that actually makes the debt problem harder to resolve.

European twists

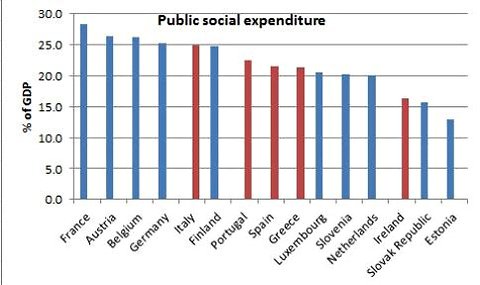

The European mess is pretty well described by the story above, with the Sams mainly in the periphery and the Janets in the core; what we’re getting is forced austerity in the periphery with no offsetting expansion in the core, and now everyone is shocked, shocked that the whole continent seems headed for recession.

In Europe’s case, however, higher inflation is even more crucial than for the United States — because Europe also needs a large adjustment of relative prices that will be very hard if not impossible to achieve with low overall inflation.

So as of this morning, the 5-year German breakeven — an implicit forecast of inflation — is only 0.9%.

This is not going to work.